how to calculate pre tax benefits

23000 is 6200 more than 16800. Calculate the employees gross wages.

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

There are two types of benefits deductions.

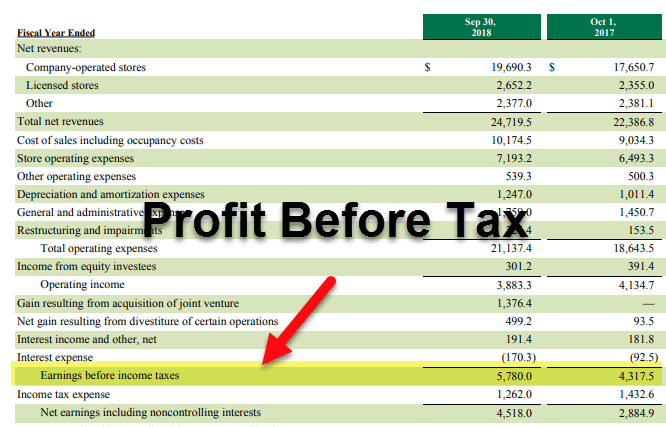

. How to calculate pre-tax health insurance. Pretax Income formula Revenues- Expenses excluding Income Taxes Examples of Pretax Income. A pretax health insurance plan generally includes medical dental and vision coverage for you your spouse and your dependents.

On completion of the construction the total pre-EMI interest paid in the subsequent years is deductible in 5 equal instalments. For example you earn 1200 biweekly. Identify potential pretax deductions.

For example if you make 12 payments of 1400 over the course of the year that adds up to a debt service of 16800. Calculate the taxable wage base for each payroll tax. Click to follow the link and save it to your.

Pre-tax deductions are payments toward benefits that are paid directly from an employees paycheck before withholding money for taxes. Identify applicable payroll taxes. It measures the total.

Pretax insurance benefits offered under a Section 125 cafeteria plan arent taxable so theyre taken out of your gross wages before taxes are deducted. Therefore you pay 5040 biweekly in Social Security tax. The deduction is 50 per payroll and you pay the employee a gross pay of 1000 per biweekly pay period.

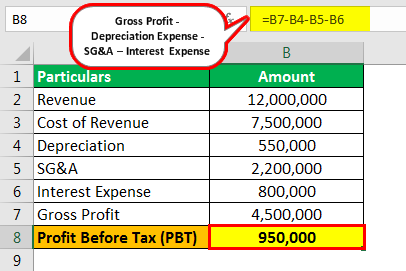

Pre-Tax Financial Income. Employer-sponsored plans are typically pre-tax deductions for employees. Using the formula above the pretax income of Company ABC is.

Subtract the value of your debt service from your NOI. This permalink creates a unique url for this online calculator with your saved information. 391000 - 101000 90000 1000 900 0 198100 Pretax Income.

Your employer may cover some of the. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

If pretax deductions are not included in taxable wages subtract the benefit from gross wages before calculating state or local income tax according to the agencys criteria. Pre-tax contributions reduce overall taxable income and provide an immediate tax-break for employees. The formula for calculating pretax income is as follows.

Follow these steps the next time you do payroll. For instance on a Pre-EMI of Rs5 lakhs Rs 1 lakh will be. How much can pre-tax contributions reduce your taxes.

Instead of the 4370 that person would have to pay in taxes for making 50000 per year they pay 4130 instead because of the 2000 theyve allotted to pre tax benefits. By offering employees a pre-tax commuter benefit program the cost of commuting deducted for employees reduces the amount of payroll being taxed. Pre-tax deductions reduce the employees taxable income which can save them money when filing their federal income tax.

Lets start by defining a pre-tax benefit plan. Visual of a Pre-tax health benefit account reflecting the 3000 of qualified pre-tax expenses and a corresponding 300 to 1000 in tax savings. 1 Types of plans.

If you do not have a cafeteria plan the entire 1200 is subject to Social Security tax. Depending on your tax. Some facts about Saras pretax deductions.

A pre-tax benefit plan is an account which you sign up for through your employer and fund through payroll. For 2022 the standard. This amount must be included in the employees wages or reimbursed by the employee.

Pre-tax deductions and post-tax deductions. In most cases deduct the employee-paid portion of the. You can be compensated between 45 and 65 of.

Pretax Income formula Profit After Tax PAT Tax Expenses. Your annual W-2 includes your. Say you have an employee with a pre-tax deduction.

Personal use is any use of the vehicle other than use in your trade or business. Its advantageous to pre-tax benefits when savings on current taxes is. This insurance covers you if youre unable to do your job due to illness disability or any severe injury.

Pre-Tax financial income is just like it sounds - its the earnings a company generates before deducting the taxes it needs to pay.

Profit Before Tax Formula Examples How To Calculate Pbt

How I Went From Broke To Owning Multiple Investment Properties My Jearney Investing Investment Property Credit Record

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

How To Get A Pre Approved For A Mortgage Mortgage Approval Mortgage Debt To Income Ratio

Withdrawals Of Pre Tax Money Including Contributions Employer Match Profit Sharing And Rollovers In A Workplace Retirement Benefits Tax Money Contribution

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

Profit Before Tax Formula Examples How To Calculate Pbt

Pretax Income Definition Formula And Example Significance

Download Adoption Tax Credit Calculator Excel Template Exceldatapro Tax Credits Excel Templates Federal Income Tax

A Us Guide To Net Pay And How To Calculate It Standard Deduction Tax Deductions Calculator

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

Canada Child Tax Benefit Things To Know Law Student Months In A Year

Mortgage Tax Deduction Calculator Freeandclear Tax Deductions Mortgage Mortgage Tips

Profit Before Tax Formula Examples How To Calculate Pbt

Earnings Before Tax Ebt What This Accounting Figure Really Means

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator